The Bonaire Hotel and Tourism Association (BONHATA) works together with its accommodation members to keep track of key indicators for the tourism industry on Bonaire and provides quarterly performance updates. At present, the indicators tracked are:

- Occupancy Rate (OCC %): The percentage of occupied rooms at any given time compared to the total number of available rooms at that time

- Average Daily Rate (ADR $): Indicates the average revenue earned for an occupied room on a given day

- Revenue per Available Room (RevPar $): Represents the revenue generated per available room and is calculated by multiplying an accommodation’s average daily room rate (ADR) by its occupancy rate.

This analysis takes a look at the performance of the first 3 quarters of 2024. Let’s dive into it:

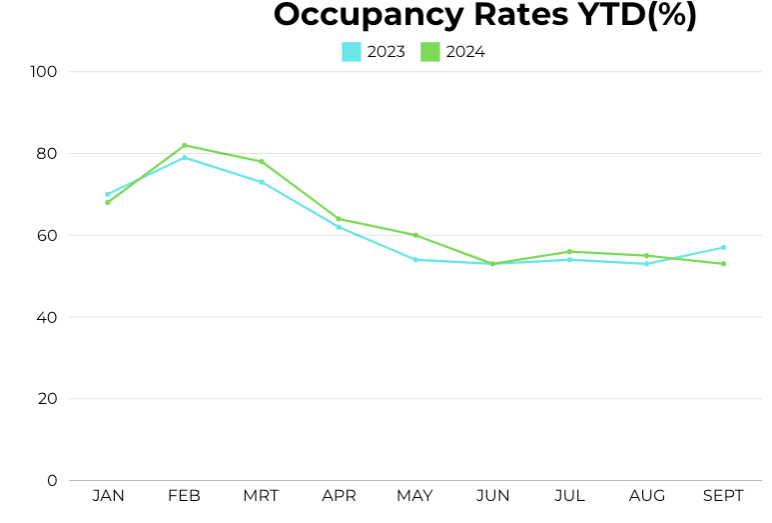

Occupancy Rates

While 2024 started stronger with 82% in February, both years show similar drops, stabilizing around 53-57% by July through September. This reflects a consistent mid-year seasonal decline in occupancy.

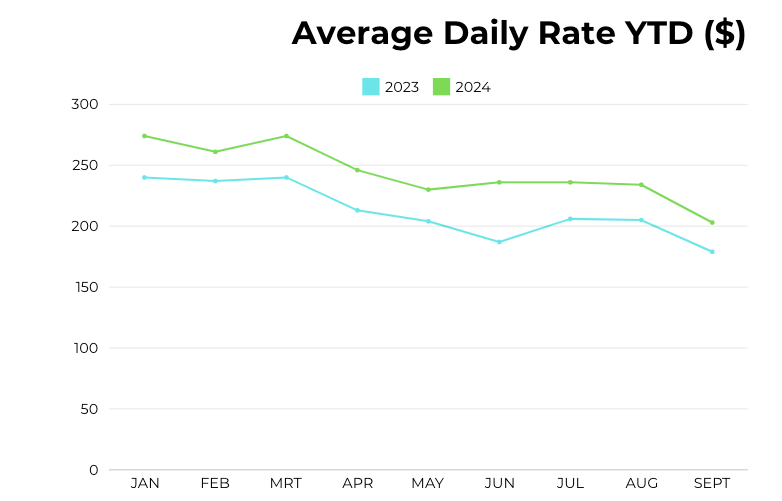

Average Daily Rate

When looking at ADR 2024 remains consistently higher than 2023 across all months. Both years see a steady decline after March, with 2024 peaking at $281 in March and 2023 at $267 in February. Rates drop notably in the summer months, with the lowest point in September for both years, reflecting a seasonal reduction in pricing.

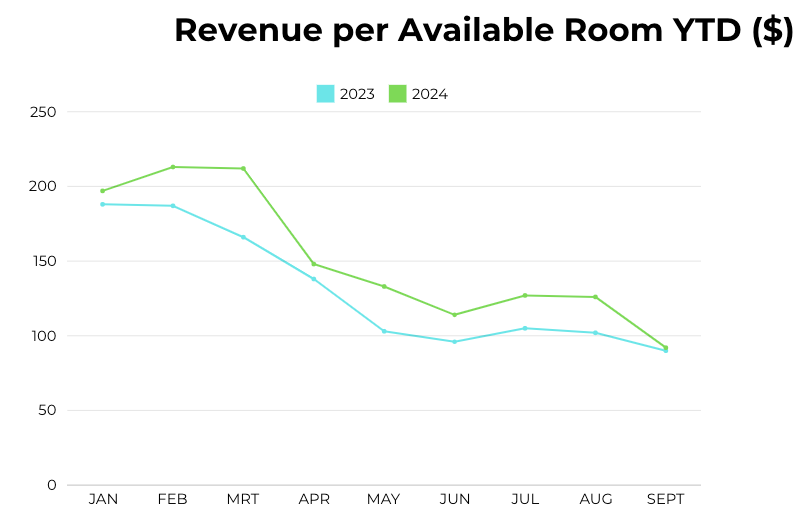

A view on RevPAR

RevPAR, which combines both occupancy and ADR, demonstrates the direct impact of low occupancy with 2024 outperforming 2023 across most months. Both years peak in February and March, with 2024 reaching $213 in February and 2023 at $187. After March, there is a steady decline, with the lowest RevPAR in September for both years. Despite a sharper drop for 2023, 2024 maintains higher values throughout the year, especially during the summer months.

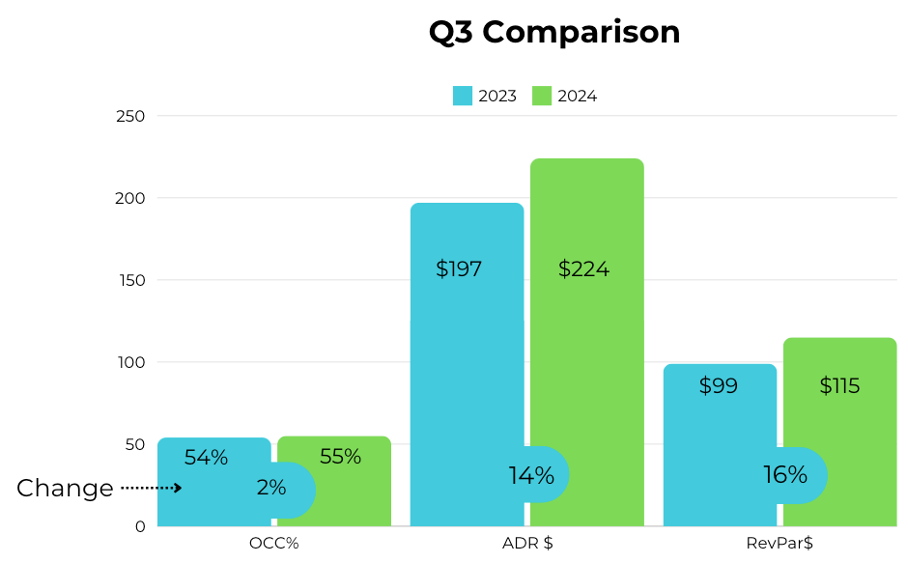

Third Quarter Comparison 2024 vs 2023

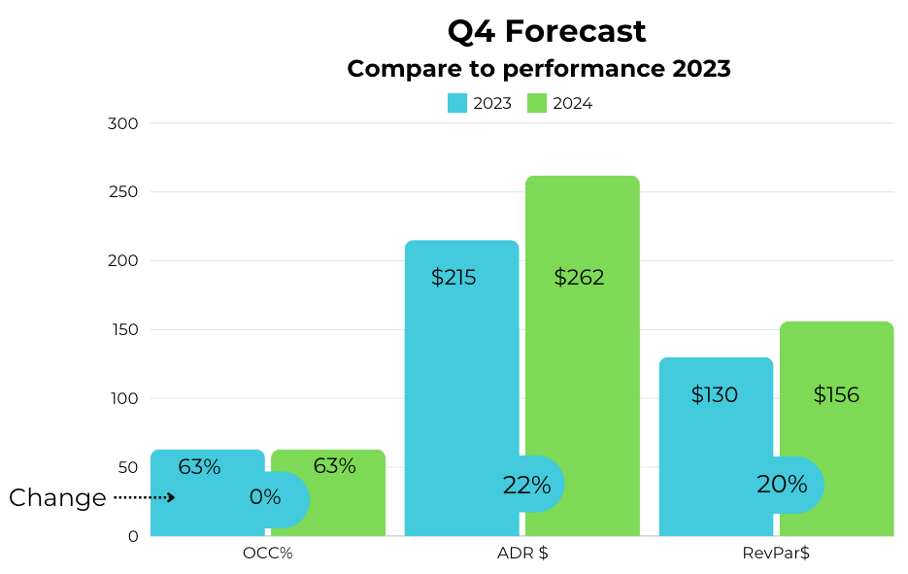

Fourth Quarter Forecast

Despite a slight rise in occupancy this year, the sector remains cautious about Q4 rate forecasts, even with JetBlue, Corendon, and WestJet entering the market.