As we move into 2025, we would like to take a moment to reflect on our performance of last year, compared to 2023 and share the forecast Q1 this year.

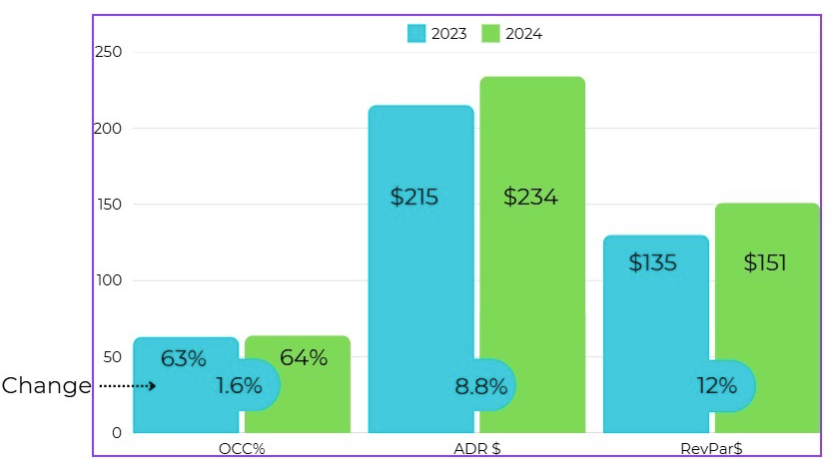

Performance Review: 2023 vs. 2024

- Occupancy Rate (OCC%): We observed a slight increase in the overall performance in 2024 (62% annual OCC) compared to 2023 (61% annual OCC). While certain months like January and March showed slight increases, the summer months (June to September) reflected a dip in demand.

- Average Daily Rate (ADR$): There was a notable increase in ADR from $213 in 2023 to $226 in 2024, demonstrating a more favorable pricing strategy.

- Revenue Per Available Room (RevPar$): RevPar saw an increase from $131 in 2023 to $140 in 2024, indicating an overall positive revenue impact despite fluctuations in occupancy.

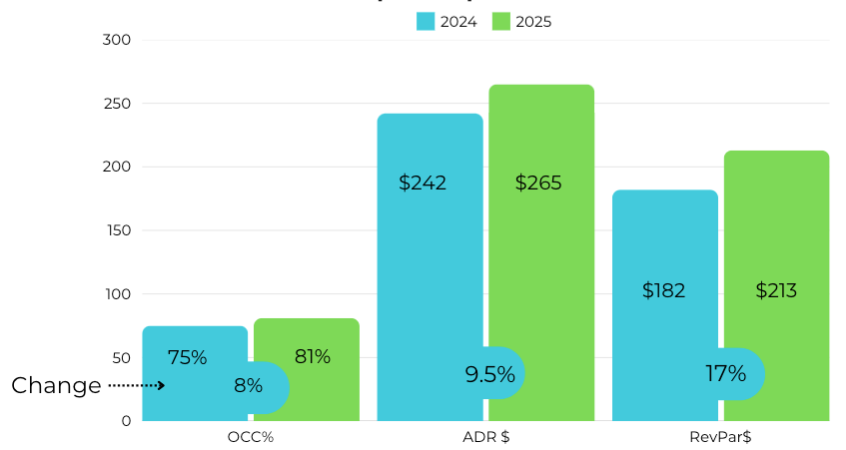

Forecast for 2025

- We anticipate stronger occupancy rates in the first quarter of 2025, with an OCC% forecast of 81% in January, 84% in February, and 76% in March.

- The ADR is expected to continue its upward trend, reaching $261 in January, $267 in February, and stabilizing at $267 in March.

- RevPar is forecasted to significantly outperform previous years, with $212 in January, $225 in February, and $204 in March.

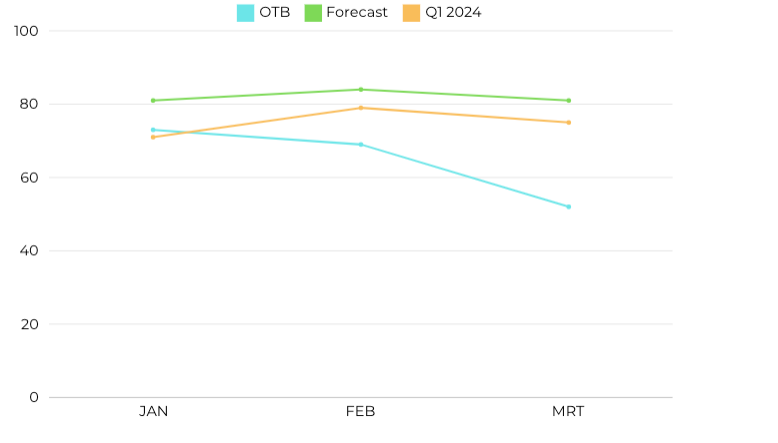

On-the-Books (OTB) Data vs. Forecast

- Early bookings for 2025 indicate a slightly lower actual OCC% than forecasted, with January showing 73% OCC (vs. 81% forecasted), February at 69% (vs. 84% forecasted), and March at 52% (vs. 76% forecasted). This suggests a need for targeted marketing strategies to drive additional bookings.

Key Takeaways & Strategies

- Maintain ADR growth: Our pricing strategies have been effective, and we should continue optimizing room rates while ensuring value for guests.

- Focus on off-peak demand: The summer months consistently show lower occupancy. Targeted promotions and partnerships can help attract travelers.

- Monitor and boost early bookings: Our 2025 “On-the-Books” data indicates a slight lag in confirmed reservations. Targeted campaigns and special offers may help close the gap.

- Stay adaptable: Market conditions continue to evolve, and flexibility in pricing and promotions will be key to maximizing revenue.

We are optimistic about 2025 and look forward to a year of growth and success.